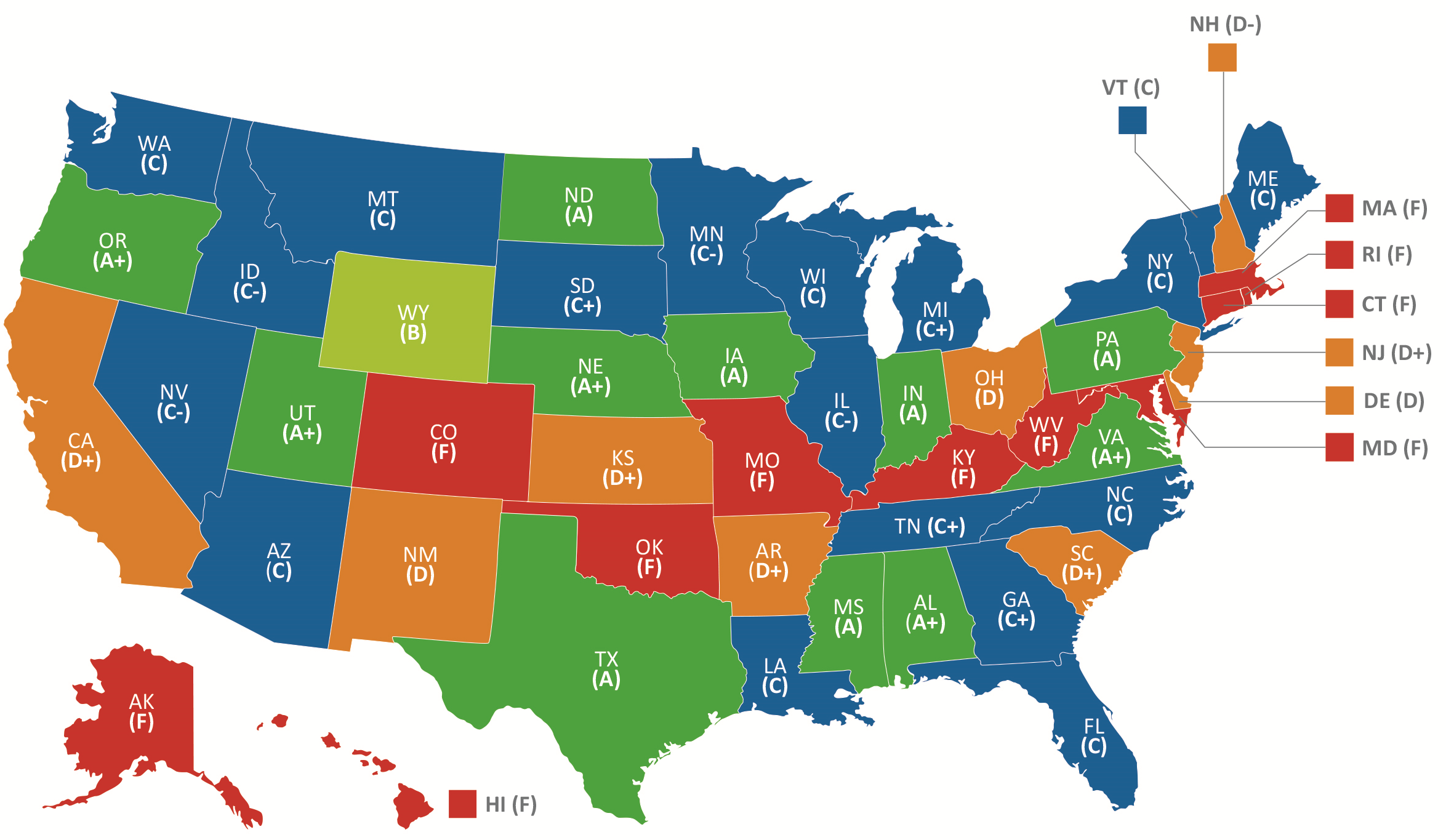

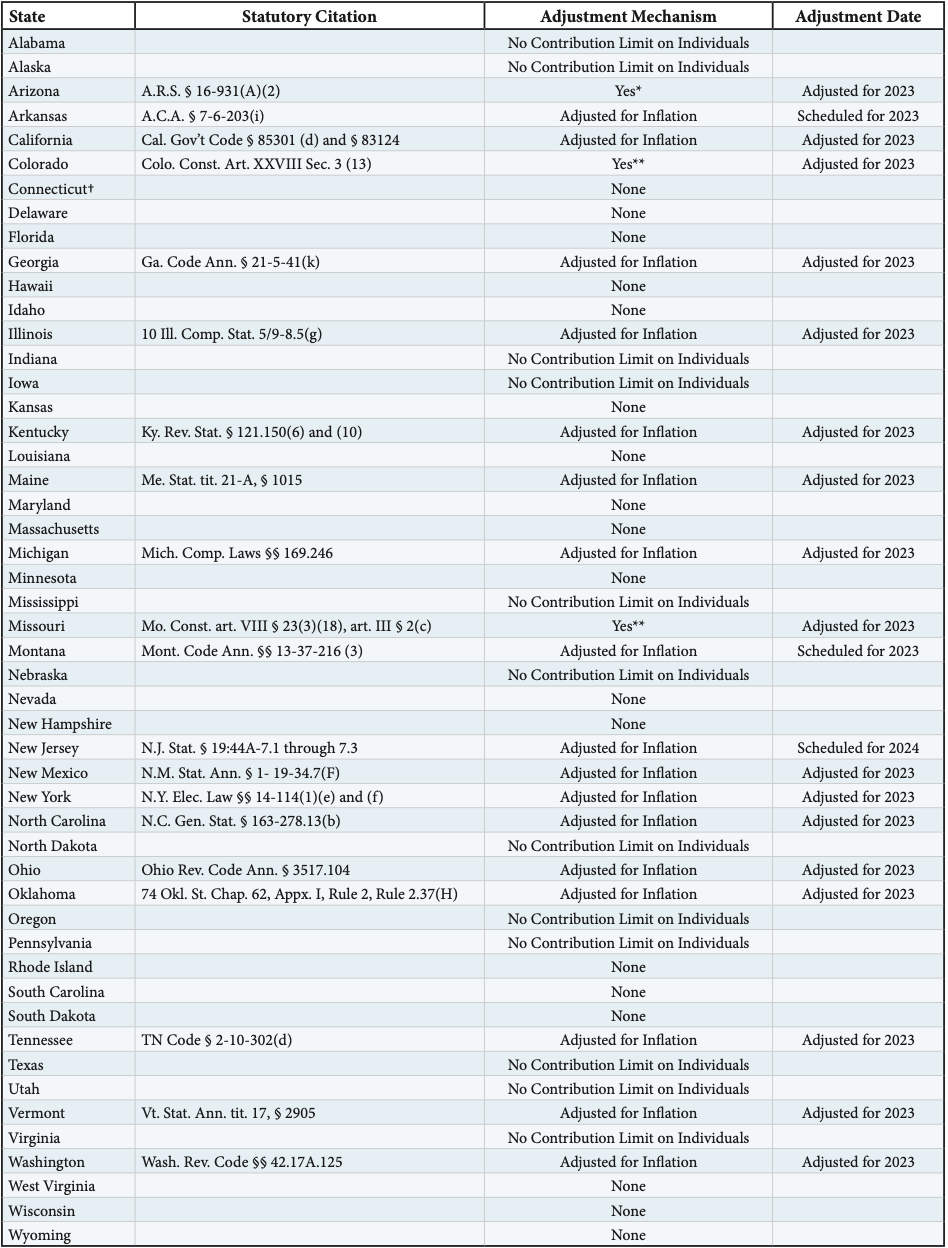

In April 2023, New Jersey became the latest state to index its candidate contribution limits to inflation. This means that 20 of the 38 states that place contribution limits on individuals now provide some mechanism to increase those limits.

Of those 20 states, 17 sensibly index their contribution limits to inflation, but three have adjustments that do not keep pace with inflation. Including the 12 states with no limits on individual contributions, the right to make campaign contributions is not eroded by inflation in 29 of the 50 states.

Without indexing to inflation each year, the purchasing power of each dollar will be reduced and will therefore erode the value of the contribution limit originally set by legislators. For example, a $1,000 contribution limit in January 2000 declined in value to just $557 by June 2023.[1] As inflation grows from year to year, it diminishes the value of contribution limits and can even result in existing limits becoming unconstitutionally low.

Failure to protect campaign contribution limits from inflation harms free political speech.

As a result, an increasing number of states have adopted laws or regulations that adjust contribution limits through an adjustment mechanism in their laws. Inflation adjustment provisions are important protections for free political speech. First, any contribution limit not adjusted for inflation will restrict the amounts candidates can raise to spend on campaign speech in the future more than it does today. Second, inflation adjustments mean that a lower limit on political giving must be adopted by passing a bill into law, instead of letting inflation silently and unaccountably erode these rights over time.

Indexing for inflation is also constitutionally important. The Supreme Court noted in Randall v. Sorrell (2006) that “[a] failure to index limits means that limits which are already suspiciously low … will almost inevitably become too low over time.” As the Court further explained, this “means that future legislation will be necessary to stop that almost inevitable decline, and it thereby imposes the burden of preventing the decline upon incumbent legislators who may not diligently police the need for changes in limit levels to assure the adequate financing of electoral challenges.”[2]

The simple move to index contribution limits to inflation ensures that future contributors to campaigns will have the same freedom to support candidates that today’s contributors enjoy. Failing to index to inflation effectively causes limits to decline year after year, steadily diminishing First Amendment freedoms and suffocating candidates, parties, and political commit- tees. The speed of this suffocation will depend on the inflation rate, a factor over which no individual or group has meaningful control.

This report analyzes all 50 states for their inflation adjustment practices for contributions to candidates for statewide offices and the state legislature. It notes states that have an adjustment mechanism, those without an adjustment mechanism, and those with no contribution limits so any adjustment is irrelevant. The report also indicates whether states have already announced the adjusted limits for 2023.

A model law that adjusts for inflation has these features:

-

-

-

- It adjusts for inflation from a base year when the contribution limit was last modified by the legislature, not to the most recent inflation adjustment. If a state indexes to the most recent adjustment, it will create rounding errors and may introduce a downward bias over time.

- It uses the CPI-U published by the U.S. Bureau of Labor Statistics (BLS). This is the most comprehensive index of inflation. Some states have indexed their limits to a CPI for a metropolitan area in their state that is published by BLS. However, this can lead to complexity as the BLS sometimes will retire or change such indexes. Use of a national index avoids difficulties inherent in switching indices.

- If it adjusts the limit to a round number, such as to the nearest $50 or $100, then it should adjust the limit upward to the nearest threshold amount to avoid erosion from rounding down.

-

-

In short, adjusting limits for inflation is a simple and uncontroversial way for states to protect political speech.

Notes:

*Arizona does not adjust limits for inflation. Rather, Arizona has a provision that automatically raises the contribution limit every two years by $100. See A.R.S. § 16-931(A)(2).

** Colorado and Missouri have constitutional provisions that provide for adjustments, but these ensure contribution limits do not keep pace with inflation. Both states purportedly run an inflation calculation every four years, but round down to the nearest $25. All other states that adjust for inflation either use an exact amount or round the amount to a threshold number (e.g. the nearest $100). Colorado’s and Missouri’s laws create a bias in the computation that devalues contribution limits over time. For example, if inflation increased by 12% over four years, Colorado’s $200 limit should increase to $224 to match inflation. However, in this example, Colorado rounds the amount down to $200, resulting in no inflation adjustment. In another four years, Colorado will again calculate the adjustment from the original $200 limit, which does not account for the inflation that previously eroded the contribution limit—creating a severe long-term bias against making any adjustment and never accurately adjusts for inflation. Indeed, this year, Colorado’s $200 limit increased $25 for the first time since the law took effect in 2003. And that increase only occurred due to recent high levels of inflation.

It is also important to note that the perverse effect of these provisions is magnified by lower contribution limits. Missouri has significantly higher contribution limits than Colorado and so the downward bias is not as large. Colorado has some of the lowest contribution limits in the country. These low limits make it much more difficult for a change in inflation to raise the number above the $25 threshold.

For Colorado see Colo. Const. Art. XXVIII Sec. 3 (13).

Missouri’s adjustments to contribution limits, if any, take place every four years for the offices of governor, lieutenant governor, attorney general, secretary of state, state treasurer, state auditor, circuit and associate circuit judges. (See Mo. Const. Article VIII, Section 23(3)(18).) The contribution limits for general assembly candidates are fixed at $2,400 for state senate and $2,000 for state representative elections. (See Mo. Const. Article III, Section 2.)

† Connecticut does not adjust its candidate contribution limits to inflation. However, it does adjust the cap for inflation on qualifying contributions to candidates seeking a grant from the Citizens’ Election Program. See Connecticut General Statutes Section 9-704(b) and 9-704(c).

[1] The CPI for All Urban Consumers (CPI-U) in January 2000 was 169.30 and rose to 303.841 by June 2023, Bureau of Labor Statistics, accessed July 14, 2023, https://data.bls.gov/pdq/SurveyOutputServlet.

[2] Randall v. Sorrell, 548 U.S. 230, 261 (2006).