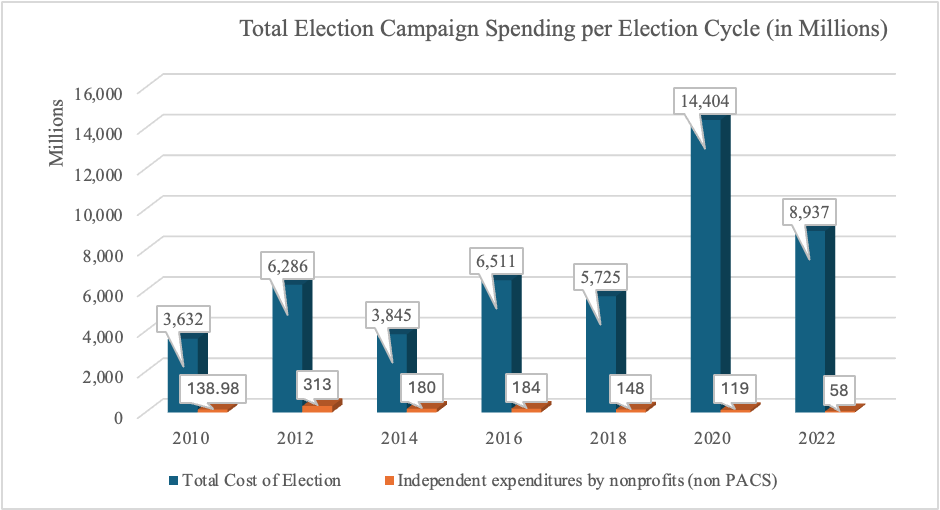

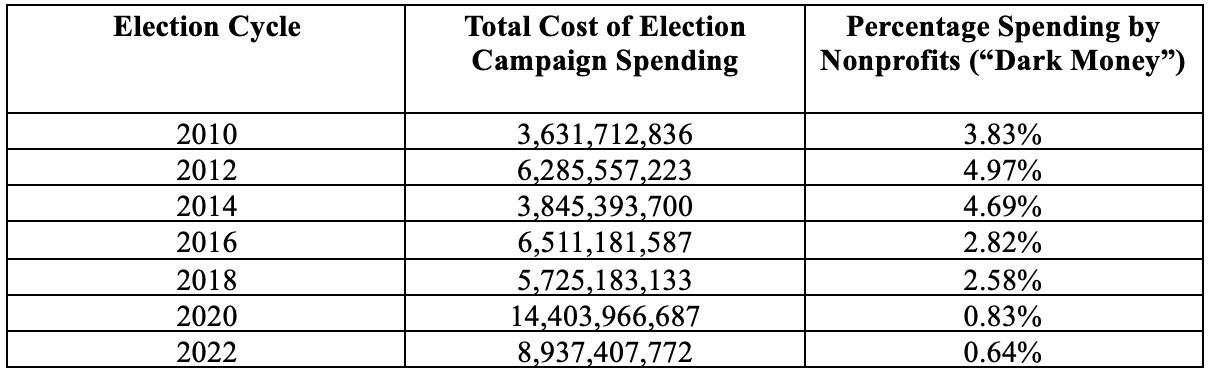

One of the principal misconceptions about “dark money” is that it accounts for a significant percentage of total campaign spending.[1]

In 2017, the Institute for Free Speech presented data showing that “the sensational rhetoric common in discussions of ‘dark money’ gives a false impression that nonprofits are a major source of campaign speech. In reality nonprofits that are not political committees consistently account for less than 5% of political spending.”[2]

Seven years later, our research shows that during the past two election cycles, nonprofits accounted for less than 1% of political spending, including campaign spending and independent expenditures. The pejorative term “dark money” is aimed at scaring the public into believing that nonprofits, which are not necessarily required to disclose their donors if the groups make independent expenditures advocating the election or defeat of candidates, are major financial players in the world of campaign finance. Nothing could be further from the truth.

The term “dark money” is used by those seeking more speech regulation and generally refers to groups that do not report donors when making independent expenditures. Hence the contention that this form of campaign spending is “dark” – presumably something shady, frightening, and underhanded.

It is a profoundly misleading term. Nonprofits cannot simply operate in the “dark,” spending millions of dollars on political campaigns without the federal government’s knowledge. Nonprofits are subject to extensive political spending disclosure requirements and are bound by IRS guidelines pertaining to their tax-exempt status.[3] Nonprofits that are not PACs cannot spend more than half, if that, of their funds on election campaign advocacy.

It is indeed true that federal law treats nonprofits differently from political committees – but with good reason. Political campaigning is not the primary activity of nonprofits. Consequently, they do not shoulder the same disclosure burden as political committees. The overwhelming majority of contributions to nonprofits are not earmarked for speech related to political campaigns, and, therefore, donors’ identities need not be disclosed. When funds given to these nonprofits are earmarked for independent expenditures, those donations, if over $200, must be disclosed.

As the chart and table presented here demonstrate,[4] so-called “dark money” has consistently accounted for a very small percentage (less than 5%) of total election campaign spending. Advocates of greater campaign finance regulations (a) use the term “dark money” to scare the public, and (b) contend that campaigns are awash in this kind of spending. In short, the data do not support that contention; nonprofits’ election campaign spending simply is not a major financial force.

[1] Matt Nese, “Five Misconceptions about ‘Dark Money,’” Institute for Free Speech, https://www.ifs.org/wp-content/uploads/2015/07/2015-07-08_IFS-Issue-Brief_Nese_Five-Misconceptions-About-Dark-Money.pdf

[2] Luke Wachob, “Putting ‘Dark Money’ In Context: Total Campaign Spending by Political Committees and Nonprofits per Election Cycle,” Institute for Free Speech, https://www.ifs.org/blog/putting-dark-money-in-context-total-campaign-spending-by-political-committees-and-nonprofits-per-election-cycle/

[3] Nese, “Five Misconceptions.”

[4] The data used to compile the chart and table were taken from Open Secrets, “Cost of Election: Total Cost of Election (1990-2022),” https://perma.cc/5K52-BGP6, and Open Secrets, “Disclosure: Outside Spending by Disclosure, Excluding Party Committees,” https://perma.cc/3THW-J5F3.