In this study, California election law attorney Allison Hayward analyzes the historical roots of the IRS’s recent scandals, and discusses how:

- The IRS scandal is just the latest in a series of clashes between the agency and nonprofit advocacy groups.

- Congress writes tax law to address short-term political goals, often ignoring long-term problems.

- Laws governing tax treatment of nonprofits are often unclear.

- The IRS has a history of pushing the limits of its statutory authority to regulate groups exercising First Amendment rights.

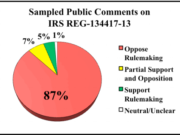

- Tax collectors apply regulations strictly and examine groups inconsistently and selectively, with a focus on controversial groups.

- Tax collectors often interpret exemptions much more narrowly than Congress intended.

- Congress or the courts have often had to step in to secure the rights of nonprofit groups against IRS overreach.

- Technical burdens and legal uncertainty have historically been major obstacles for nonprofit advocacy groups seeking tax-exempt status.

- The IRS is not able to effectively regulate nonprofit groups that engage in political speech.

Ultimately, Hayward concludes her paper by urging readers to “draw several lessons from this history.” First, the Internal Revenue Service, while effective at raising revenue, is a poor agency to task with regulating advocacy organizations, especially those that cannot offer donors a tax deduction. Only trivial amounts of revenue are at stake. Whether a certain message, or viewpoint, or advertisement, or tone is proper should not be a concern of the tax man. Second, Congress must resist the temptation to even political scores through tax legislation. Not only is it poor governance, but it rarely works. Finally, the courts should remain vigilant in protecting groups from Service overreach and congressional mischief. While it remains a canard of legal analysis that nobody has a right to avoid paying taxes, in this context – again – revenue is not the issue. Courts should feel free to identify and excise laws, even tax laws, which abridge political freedoms.

https://www.ifs.org/wp-content/uploads/2015/06/Hayward_Eternal-Inconsistency.pdf