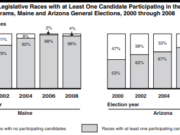

The implementation and expansion of tax-financed campaign programs in a few states and municipalities around the U.S. over the past decade raised the specter of significant changes in the financing of campaigns at the state and local level. Tax-financing advocates claimed that these programs would increase electoral competition, reduce the influence of campaign contributors and lobbyists, and change the distribution of political power. While there was evidence of a modest increase in competitiveness, primarily through a reduction in the number of incumbents who ran uncontested, the longer-term pattern has shown no significant change in incumbency reelection rates, margins of victory, or legislature demographics. Claims of major policy change have also been overstated by these programs’ proponents. Furthermore, the Supreme Court’s rejection of spending triggers for additional grant awards in Arizona Free Enterprise PAC v. Bennett makes taxpayer-financed campaign programs less attractive, since tax-funded candidates are less able to keep pace with nonparticipating opponents or independent expenditures. The author, Kenneth R. Mayer, concludes that future research should focus on how these programs affect the way that candidates and legislators engage with the public.

Read the full research here.